VWAP Pullback Strategy: Trade with Volume, Not Emotion

Struggling to tell whether the market is bullish or bearish, or when to enter without chasing price? The VWAP pullback strategy explains how to trade intraday pullbacks in a clear and practical way for both new and experienced traders.

What Is VWAP and Why Traders Use It

VWAP (Volume Weighted Average Price) is a widely used intraday indicator that represents the average price weighted by traded volume. Unlike simple moving averages, VWAP reflects where the majority of trading activity has taken place, making it a valuable reference point for both institutional and retail traders.

In practice, VWAP often acts as:

- a dynamic support or resistance level,

- a benchmark for fair value,

- a tool to define intraday trend bias.

From a structural perspective, VWAP consists of:

- the central VWAP line, representing session fair value,

- upper and lower VWAP deviations, which measure how far price has moved away from that value.

These deviations help traders identify price extensions, areas where the market may temporarily move too far from fair value before reverting.

One of the most effective ways to apply VWAP is through a pullback-based strategy, which focuses on entering trades after price expands away from one of the VWAP deviations and then retraces back.

Core Idea Behind the VWAP Pullback Strategy

The VWAP pullback strategy focuses on joining an existing intraday trend after a temporary retracement. Instead of entering impulsively during strong moves or waiting for a reversal, traders wait for the price to pull back toward the VWAP line, which may give them better entries and a higher success rate.

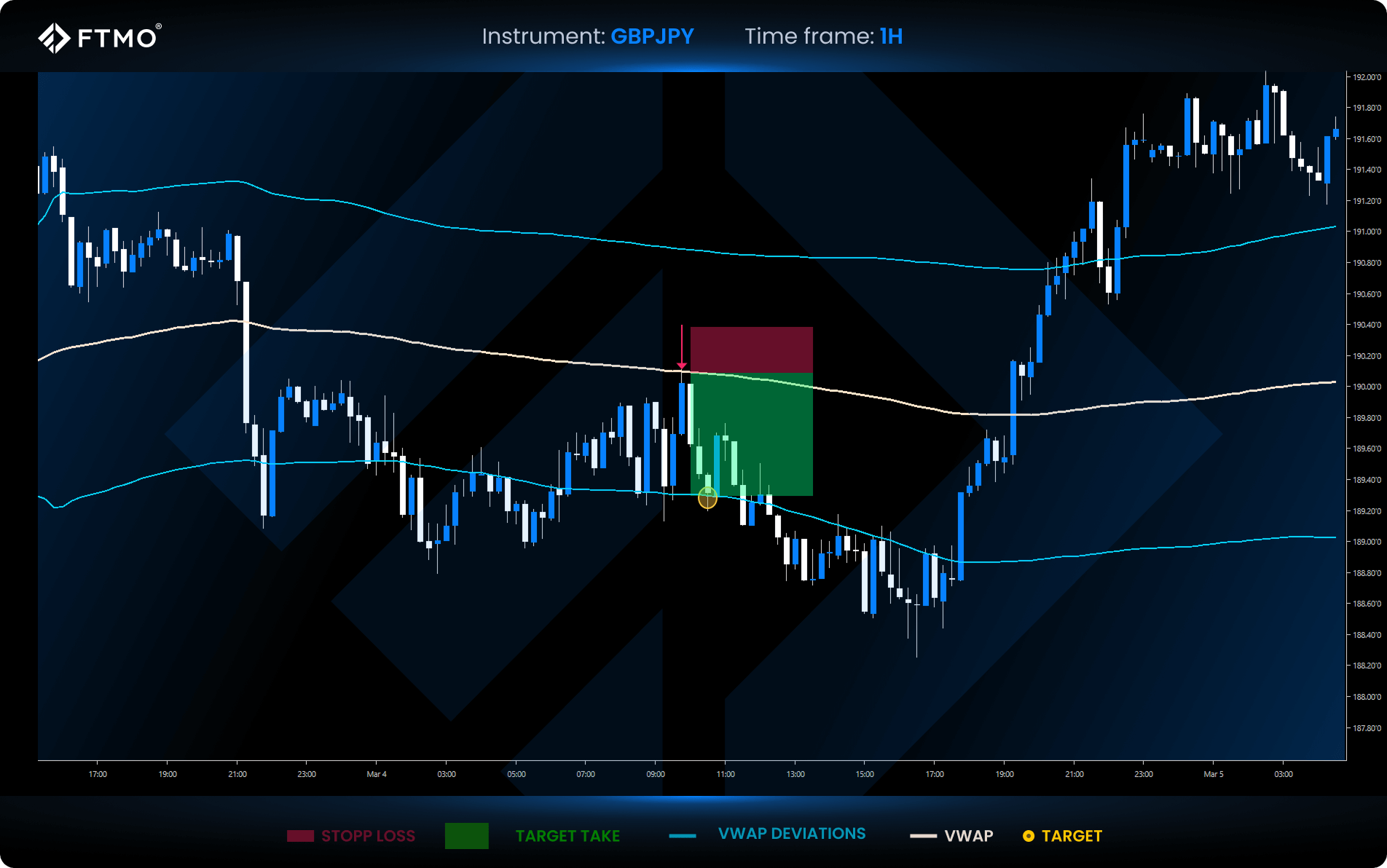

Entry Rules Example

Long entry: Wait for price to rise above a VWAP deviation, then enter on a pullback to the VWAP line.

Short entry: Enter a short position when price falls below a VWAP deviation and, again, enter the trade on a pullback to the VWAP line.

Stop-Loss and Targets Example

Stop-loss: Set your stop-loss just above (for short trades) or below (for long trades) the VWAP line.

Profit target: Aim for the VWAP deviation or use a trailing stop for larger trades.

When the Strategy Works Best

The VWAP pullback strategy works best when the market shows clear intraday direction and healthy momentum. Ideally, price should move decisively away from VWAP toward one of the deviation bands, confirming that buyers or sellers are in control.

The most favorable conditions include:

- strong directional moves during the London or New York session,

- a clean expansion toward a VWAP deviation followed by a smooth pullback,

- price respecting the central VWAP line as dynamic support or resistance.

In these environments, VWAP acts as a reliable value zone, allowing traders to enter trends without chasing price.

Key Takeaway

The VWAP pullback strategy offers a structured way to trade intraday trends by using VWAP deviations for momentum confirmation and the central VWAP line as a precise execution and risk management zone.

Overall, the VWAP pullback strategy provides a simple way to read intraday trend direction and time entries without chasing price or overcomplicating decision-making.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO developed a unique Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. Click here to learn more about how it works.